SAP Insights surveyed midmarket executives to find out how their companies are incorporating sustainability into their business strategies, how they might use it to drive growth, and what technology’s value is in supporting sustainability. We broke out survey respondents with annual revenues of less than US$1 billion, then divided them into three distinct groups by revenue from smallest to largest.

Beginning to follow the money

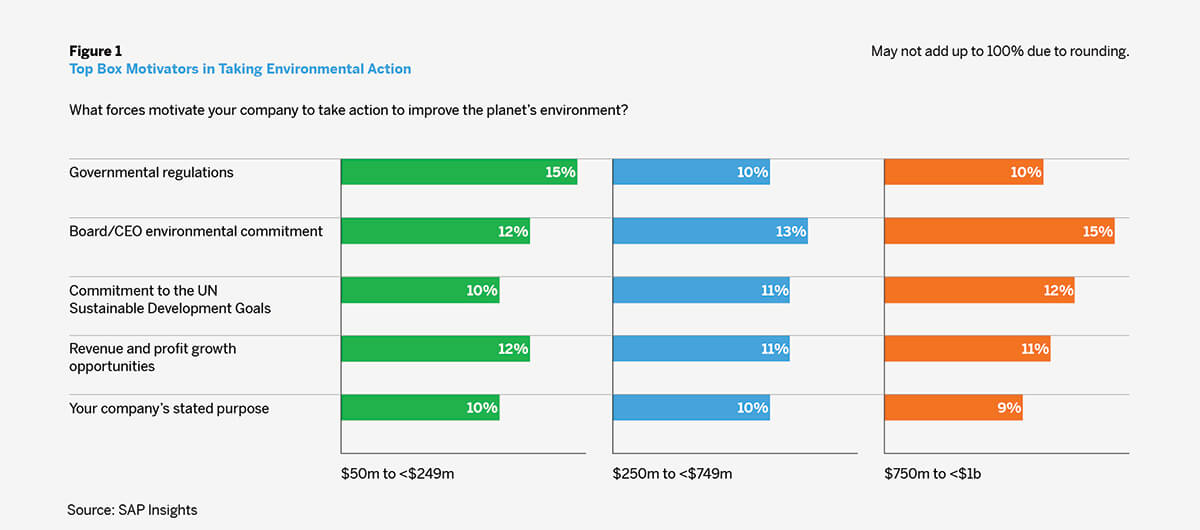

The research shows that midsize companies have both external and internal motivations to take action to improve the environment. Across all three groups, the top drivers are government regulations, commitment to the Sustainable Development Goals of the United Nations, and commitment of the board of directors and CEO. Among the smallest midsize companies, the top motivation is regulatory pressure, while motivation is regulatory pressure, while the two higher-revenue contingents cite board and CEO commitment. Interestingly, the fourth-highest motivator across all groups is revenue and profit growth opportunities, suggesting that companies are beginning to perceive financial benefits in pursuing sustainability.

The silence of the supply chain

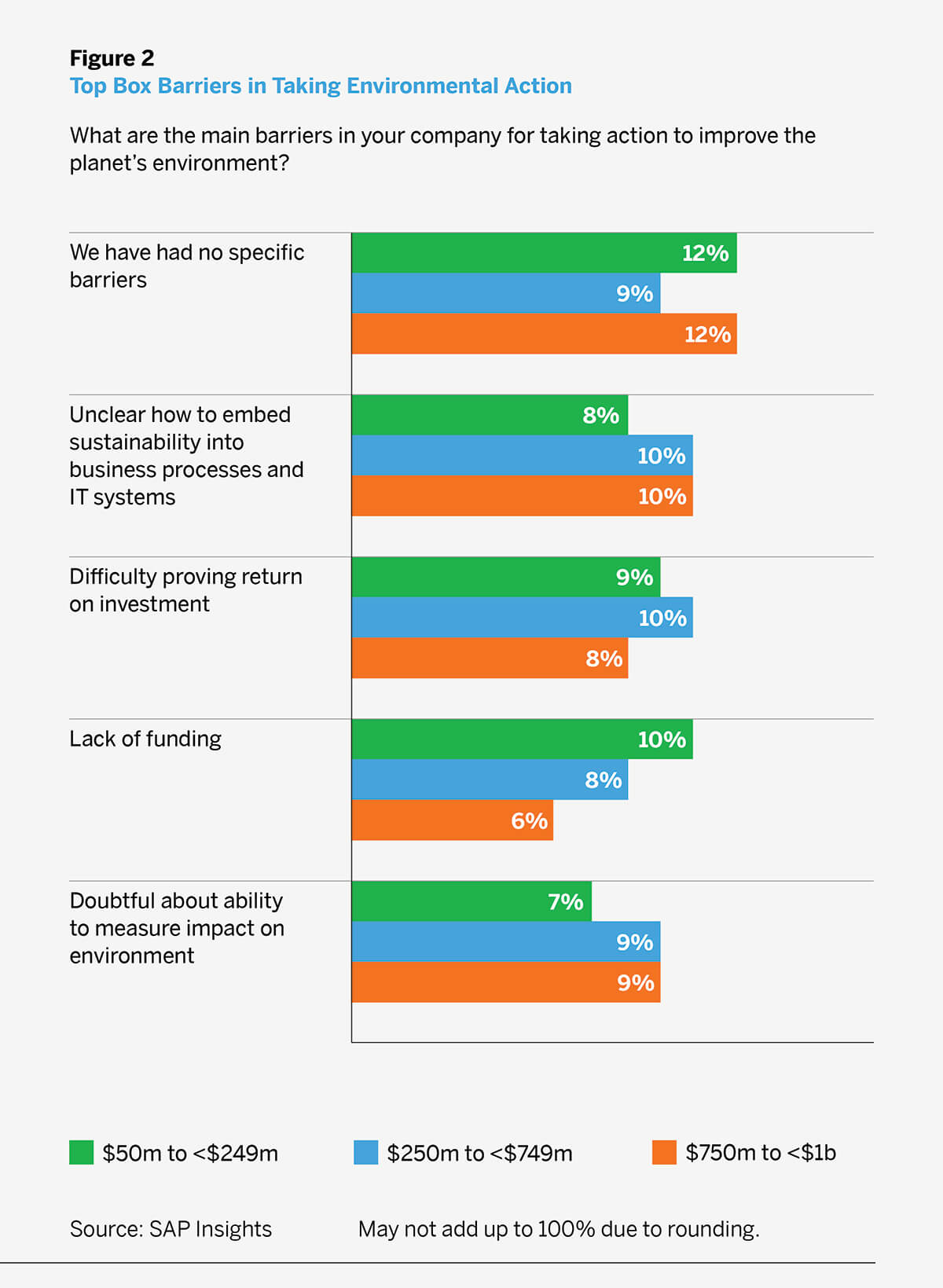

The barriers to action on improving the environment varies by segment. All the midsize companies express uncertainty about how to embed sustainability into business processes and IT systems and how to prove return on sustainability investments. But the largest companies are notably more likely to say that their partners are not asking them to act – a surprising response. But that will change as sustainability increasingly becomes a strategic imperative throughout the supply chain. The smallest companies, by comparison, are significantly more likely to say that lack of funding is their biggest barrier to action.

The barriers to action on improving the environment vary by segment. All the midsize companies express uncertainty about how to embed sustainability into business processes and IT systems and how to prove return on sustainability investments. But the largest companies are notably more likely to say that their partners are not asking them to act – a surprising response. But that will change as sustainability increasingly becomes a strategic imperative throughout the supply chain. The smallest companies, by comparison, are significantly more likely to say that lack of funding is their biggest barrier to action.

Trying to do it all

When asked to rank their top priority for investments across a variety of environmental issues, midsize respondents rate them all roughly equal importance. Interestingly, the larger a company is, the more likely it is to consider every issue a high investment priority. As with barriers to action, this likely reflects the reality that larger companies simply have more revenues to invest.

Data is crucial – but lacking

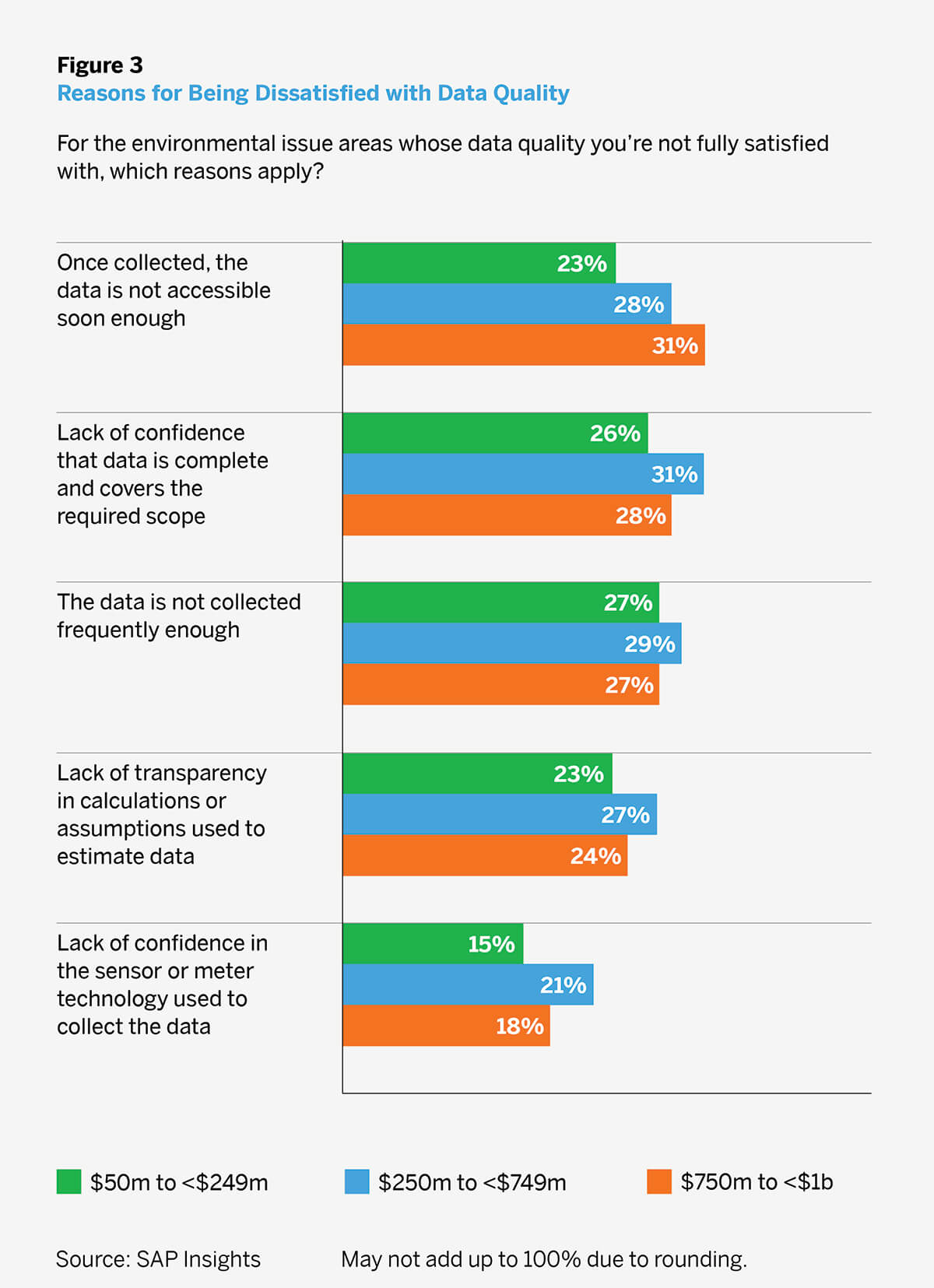

Data is at the centre of any sustainability effort. It’s part of the road map for incorporating sustainability into operations and proving ROI. It is used to identify and track environmental impacts, such as CO2 emissions or energy consumption. The signals from data break down barriers to action. Indeed, the more environmental impact data a company has and the more satisfied it is with the quality of that data, the more likely it is to recognize that sustainability data has value in driving strategic and operational decisions.

However, it’s clear from midmarket respondents that they don’t yet have all the data they need – nor is it the quality they desire. The research shows that the smallest companies are the most dissatisfied with the quality of their sustainability data.

Both the smaller and medium-size groups are the most concerned when it comes to whether the data is collected frequently enough. They also lack confidence in its completeness. Larger companies are less likely to be dissatisfied with the amount and quality of their sustainability data. Their dissatisfaction is focused on how quickly they can access it, which suggests that they are eager to use the data to drive strategy.

Sustainability data will get better

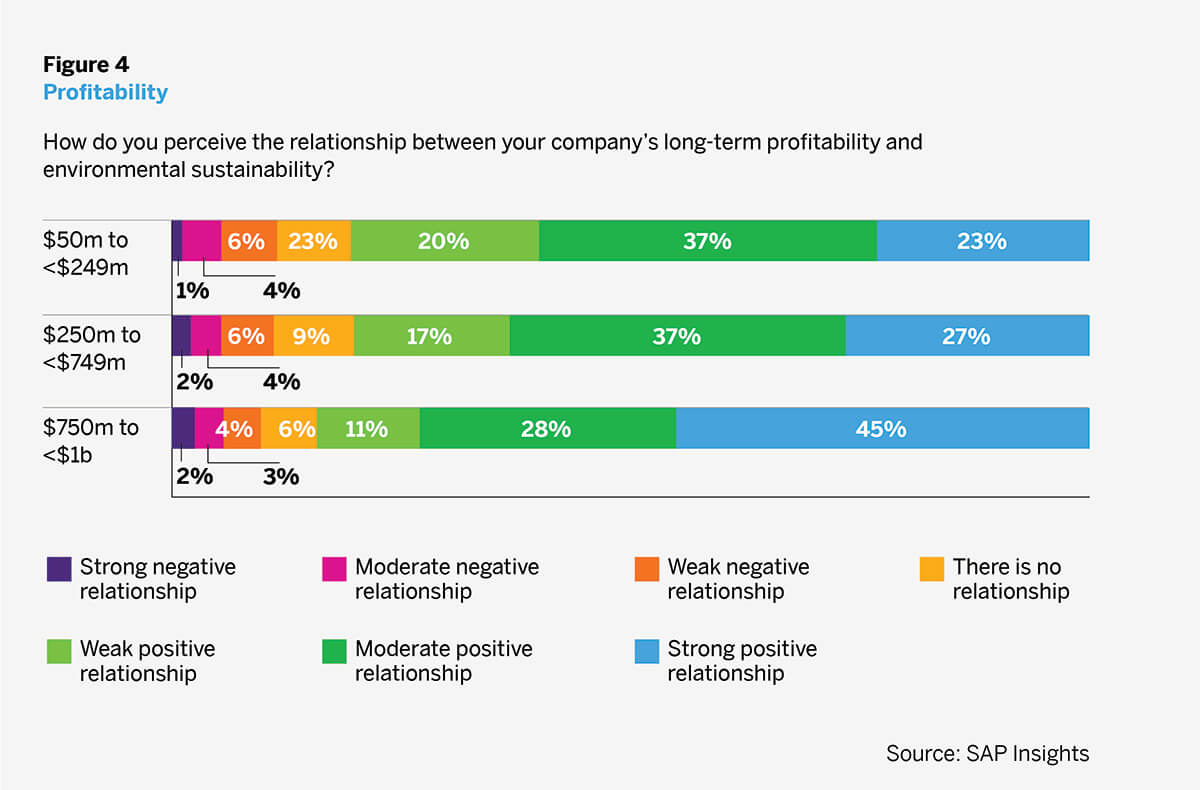

Despite the current problems with data, there are signs that they will improve. That’s because the majority of midmarket companies say that sustainability will play a strong role in their long-term competitiveness and profitability. In fact, nearly half of large, midsize companies are already incorporating sustainability data into their operational and strategic decision-making to a strong degree.

Signals from the future

Sustainability isn’t just an ethical demand, although it’s harder to do business when the planet is in crisis. It also has a direct impact on the bottom line. The SAP Insights research shows that the larger a company is, the more likely it is to pay attention to sustainability. That should be a signal for companies looking to grow.

While the data doesn’t draw a direct line between attention to the environment and business success, it suggests taking action sooner rather than later. With environmental sustainability becoming a top concern for regulators, consumers, and investors, companies of all sizes will experience more pressure in more ways to take responsibility and action. If these actions make them compliant before compliance is required, they can avoid potentially damaging penalties. And as customers increasingly demand that companies demonstrate concrete action on environmental stewardship, businesses that provide greater transparency into their efforts are better positioned to grow.

Know where you stand

To pursue sustainability as part of a business strategy, midsize companies should first know where they stand in terms of environmental impact. With this understanding, they can identify where they can make the most meaningful changes to mitigate negatives and foster positives.

Applicable for Package

Applicable for Package Optional

Optional